6 Competitor Monitoring and Intelligence Tools for 2026

Competitor monitoring tools help revenue teams track competitive activity, detect evaluation signals, and prioritize accounts likely to be in-market.

But not all competitor monitoring tools are built for sales.

Some focus on:

- Market research

- Website change tracking

- Battlecards

- Executive intelligence

Others focus on surfacing real buying motion and delivering opportunities directly to your CRM.

If you're evaluating competitor monitoring tools today, this guide breaks down:

- What competitor monitoring tools actually do

- Which tools surface competitive evaluation

- Which tools generate actionable pipeline

- Where each tool fits in a GTM stack

What Are Competitor Monitoring Tools?

Competitor monitoring tools track changes and activity related to competing vendors.

Depending on the platform, this may include:

- Website updates

- Messaging and positioning shifts

- Product launches

- Pricing changes

- Press releases

- Hiring

- Buyer research behavior

However, for B2B sales teams, the most important question is:

Does the tool identify accounts actively evaluating competitors?

1. Letterdrop: Detect Competitive Evaluation and Route Actionable Opportunities

Best for: Turning competitor evaluation into CRM-ready opportunities

Letterdrop is designed to surface buyers who are beginning to evaluate competing vendors, before those conversations ever show up as inbound.

Instead of monitoring competitors for vanity metrics or mentions, Letterdrop focuses on buying behavior:

- identifying accounts actively exploring solutions in your category

- enriching those opportunities with context

- routing them directly into your CRM

- preparing next-step recommendations for reps

This allows teams to engage buyers while vendor decisions are still forming, rather than reacting after the deal is lost.

Why Letterdrop stands out

Most competitor monitoring tools stop at intelligence. Letterdrop delivers ready-to-work opportunities, updated daily, aligned to sales workflows.

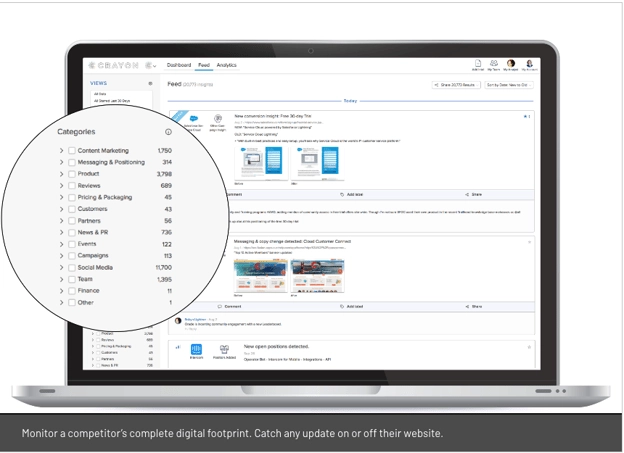

2. Crayon

Best for: Continuous competitor tracking and sales enablement

Crayon monitors competitors across websites, messaging changes, pricing pages, product launches, and announcements, then surfaces alerts and battlecards for internal teams.

Where it fits

- Competitive intelligence programs

- Sales enablement and product marketing

- Monitoring competitor positioning changes

Limitations

- Designed for internal intelligence, not pipeline generation

- Does not identify buyers evaluating competitors

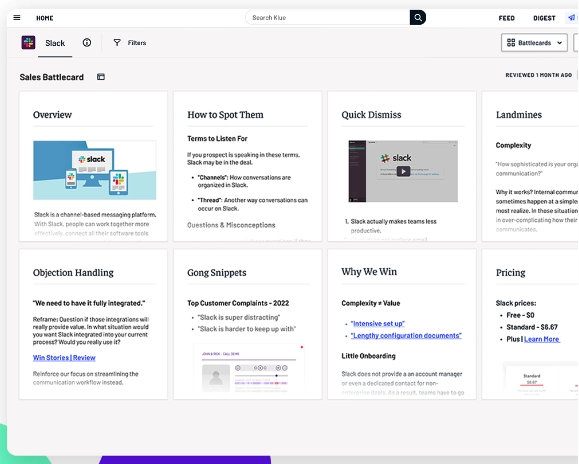

3. Klue

Best for: Battlecards and competitor intel distribution

Klue aggregates competitor updates and turns them into curated battlecards and alerts that sales teams can reference during deals.

Where it fits

- Sales enablement

- Competitive positioning

- Deal support late in cycle

Limitations

- Focused on enablement, not demand or signal generation

- No buyer or account discovery

4. AlphaSense

Best for: Market-level and competitor research

AlphaSense is used heavily by strategy and research teams to monitor competitors, markets, earnings calls, and analyst commentary.

Where it fits

- Strategic planning

- Market and competitor research

- Executive intelligence

Limitations

- Not designed for GTM execution

- No workflow into sales or CRM

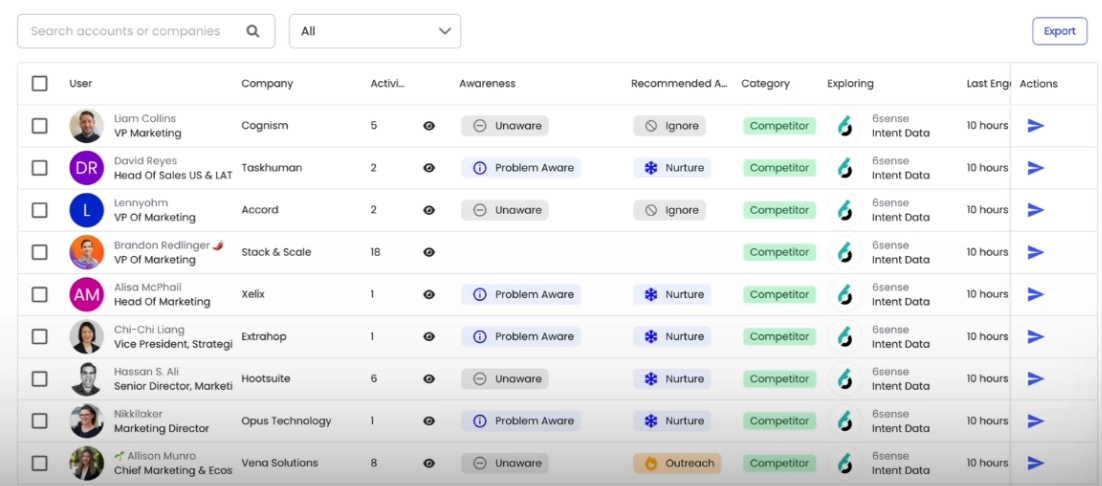

5. 6sense

Best for: Account-level competitive research signals

6sense detects anonymous account-level research behavior, including interest in competitor topics and alternative solutions, then stages accounts based on buying readiness.

Where it fits

- Enterprise ABM motions

- Prioritizing accounts researching competitors

Limitations

- Account-level only; no contact visibility

- Signals require interpretation and orchestration

6. Common Room

Best for: Aggregating category and conversation intelligence

Common Room unifies signals from communities, product usage, and public conversations into dashboards and alerts. Some teams use this to observe when competitors come up in broader discussions.

Where it fits

- Market and category awareness

- Community-led insights

Limitations

- Not a dedicated competitor monitoring tool

- Does not surface buyers evaluating competitors or deliver sales opportunities

Competitor Monitoring Tools Compared

| Tool | Built for Competitor Monitoring | Surfaces Competitive Evaluation | Contact-Level Visibility | CRM Delivery | Best For |

|---|---|---|---|---|---|

| Letterdrop | ✔ | ✔ | ✔ | ✔ | Pipeline creation |

| Crayon | ✔ | ⚠ | ❌ | ❌ | Competitive intelligence |

| Klue | ✔ | ⚠ | ❌ | ❌ | Sales enablement |

| AlphaSense | ✔ | ⚠ | ❌ | ❌ | Market & strategy research |

| 6sense | ❌ | ✔ (account-level) | ❌ | ✔ | Enterprise ABM |

| Common Room | ❌ | ⚠ | ⚠ | ⚠ | Insight layer / community data |

How to Choose the Right Competitor Monitoring Tool

Ask:

- Do we need intelligence or pipeline?

- Do we want dashboards or CRM-ready opportunities?

- Are we monitoring market shifts or detecting active evaluation?

- Does the tool integrate into rep workflow?

If your primary goal is awareness, enablement tools may be enough.

If your goal is to engage buyers while competitive decisions are still open, you need signal-to-opportunity routing.

FAQ: Competitor Monitoring Tools

1. What is the difference between competitor monitoring and competitive intelligence?

Competitor monitoring tracks updates and activity.

Competitive intelligence organizes that information into analysis and battlecards.

Neither necessarily identifies accounts actively evaluating competitors.

2. Do competitor monitoring tools show who is evaluating my competitors?

Most tools do not surface specific accounts or contacts evaluating competitors.

Some intent platforms show account-level research signals, but require additional orchestration.

3. Which competitor monitoring tools are built for sales teams?

Most tools are built for marketing or strategy teams.

Few are designed to detect competitive evaluation and deliver pipeline directly to sales.

Final Thoughts

Most competitor monitoring tools help teams observe the market.

Very few help them act while decisions are still open.

If your goal is to surface buyers evaluating competitors and deliver those opportunities directly to sales — without stitching together intelligence tools, dashboards, and manual workflows — Letterdrop is built specifically for that motion.

Subscribe to newsletter

No-BS GTM strategies to build more pipeline in your inbox every week

Related Reading

Some other posts you might find helpful

.png)

.png)